How do we get the cogs in motion? Interpreting Sustainability Trends

I’ve been wanting to write about sustainability for a while… My growing appreciation of systems thinking and reading in sustainable finance/geopolitics means I want to read/discuss pieces which go beyond the headlines and tackle underlying issues.

Here is an overview of pieces from leaders which not only captured my attention but highlight movements for 2026 and beyond.

Kaushik’s article captures an implication of mandatory climate-reporting and regulation – demanded upskilling of sustainability in existing roles. Examples highlighted included:

· Finance Professionals learning carbon accounting

· Engineers modelling transition risk

· Procurement managers tracing modern slavery exposure

Where in the past, ESG/Sustainability teams held main expertise, the integration of sustainability within enterprise risk and financial decision has created a skills gap internally. As such, companies also rely on advisories and specialist sustainability consultants to help them level up.

Kaushik outlines the four key skill deficits: financial fluency in sustainability teams, sustainability literacy in finance teams, operational integration, leadership and governance.

Why it is important: It creates a significant shift in sustainability integration within organisations. The ESG skillset will no longer be siloed, while ESG professionals must also upskill in finance and audit areas. Capacity-building in the space gives Australia huge opportunity to not only reduce the skills gap but ensure our directors and universities are well prepared.

Did we get climate finance all wrong? Zero: The Climate Race Podcast (Bloomberg)

In this insightful interview, Lisa Sachs discusses with host Akshat Rathi, about the flaws in the current approach to climate finance and disclosure underpinned by Mark Carney’s (then Governor, Bank of England) famous 2015 ‘Tragedy of the Horizon’ speech. Sachs essentially argues disclosure and risk assessments has not reallocated capital to decarbonisation or climate solutions, due to the dependency of individual entities to the system – such as energy, transport, built environment.

The key? For companies to recognise and institutions it is in their self-interest to advocate and finance the transition for an efficient and resilient energy systems. The challenge not being so much the technology, but deployment.

Why is it so important? Sachs critically questions and provides an alternative to the widely accepted theory of change in corporate sustainability and reinforcing “markets follow the real economy.” Practitioners have noted the growing disconnect between compliance requirements and frameworks, and real-world emissions reduction. A compelling case is offered for influencing the decarbonisation systems and industries, which may mean a re-interpretation of fiduciary duty or self-interest, for many organisations.

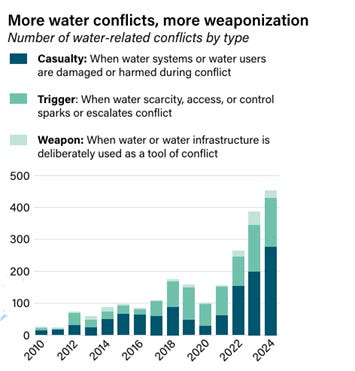

Water will intensify as a sovereign risk and national security threat. 1.8 billion people face absolute water scarcity, with population growth and urbanisation in Latin America and Asia increasing demand for hydropower dams. However, there lacks legislation and framework on water governance – which armed groups can leverage to decimate and control populations and worsen conflicts (e.g. Sahel jihadist group in West Africa).

Why is it important? Water use and scarcity are particular vulnerable due to climate change, but now even more so as a result conflict and lack of social cohesion. The number of water-related conflicts has increased exponentially since 2010 as has the number of casualties harmed (please see image below).

Luke’s article challenges the Western Hemisphere perception of China’s role in the energy transition. It highlights “green arbitrage” - China continues to generate and invest in coal domestically while exporting decarbonisation technology to the West, of whom do not have industrial capacity to deliver on their lofty transition ambitions.

Why it is important? The versatility of China’s energy capability is a deliberate move. The sheer scale and deployment of its renewable deployment is fuelled by fossil fuel production, both domestically and to Global South nations prioritising their development needs. The arms race for energy production will truly be determined by decarbonising manufacturing.

Vis Vythilingam is an ESG Analyst and founder of Greenfluence, a sustainability podcast and education platform for young people.